The Philippines has implemented significant tax reforms in recent years with the goals of modernizing the tax system, attracting investment, supporting small businesses, and boosting economic growth. One significant change that lowered corporate income tax rates and updated tax incentives was the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, which was passed in 2021. Following this, the recently signed CREATE MORE (Maximize Opportunities for Reinvigorating the Economy) Act, signed by the President on Nov. 11, expanded upon CREATE, seeking to enhance and broaden incentives. Here, we examine the CREATE MORE Act’s main features and possible advantages.

CORPORATE INCOME TAX RATE FOR RBEs

One of the major amendments is the introduction of the 20% Corporate Income Tax (CIT) Rate for Registered Business Enterprises (RBEs) under the Enhanced Deductions Regime (EDR) on their taxable income derived from registered projects or activities during the taxable year.

The previous EDR under the CREATE Act allowed additional deductions for companies. Under the CREATE MORE Act, the 20% tax rate will effectively reduce overall tax liabilities of companies while benefiting from EDR on qualifying expenses at the same time.

This change can be seen as a response to the Organization for Economic Co-operation and Development’s (OECD) Pillar Two Global Minimum Tax (GMT) rate requirement of 15%. By introducing the 20% tax rate under the EDR, the Philippines creates a clear tax structure that makes it easier for businesses to align with global standards while still enjoying significant deductions on R&D, training, and other qualifying expenses.

EXPANDED DEDUCTIONS UNDER EDR

Another salient amendment is the increase in the percentage of deductible expense items under the EDR to further incentivize businesses. As an example, the Act increased the additional deduction for power expenses to 100% from 50%, making it more attractive for businesses to invest in energy-intensive industries such as manufacturing and logistics. This increased deduction on power expenses effectively cuts costs, addressing concerns about high electricity costs in the Philippines, which has been one of the major considerations of businesses in investing in energy-intensive industries.

Additionally, the Act introduces new deductible expense items related to trade fairs and exhibitions, which can help businesses expand their market reach and promote their products internationally. The Act also now allows the Net Operating Loss to be carried over as a deduction within the next five consecutive taxable years immediately following the last year of the Income Tax Holiday (ITH) period of the project instead of carrying it over within the next five consecutive taxable years immediately following the year of such loss.

These adjustments are intended to provide businesses with more significant tax relief, encouraging them to invest in R&D, employee development, and market expansion while also supporting industries critical to the country’s economic growth.

ELIGIBILITY CRITERIA FOR RBEs

Under the CREATE Act, incentives were available for only registered export enterprises (REEs) and domestic market enterprises (DMEs). The CREATE MORE Act eases this requirement by expanding the scope of eligible businesses to encompass “registered business enterprises,” which now includes both foreign and local businesses subject to certain conditions. This amendment is going to broaden the range of companies that will qualify for the EDR and SCIT options in a bid to promote the Philippines as an ideal investment destination.

PERIOD OF AVAILMENT AND INCENTIVES

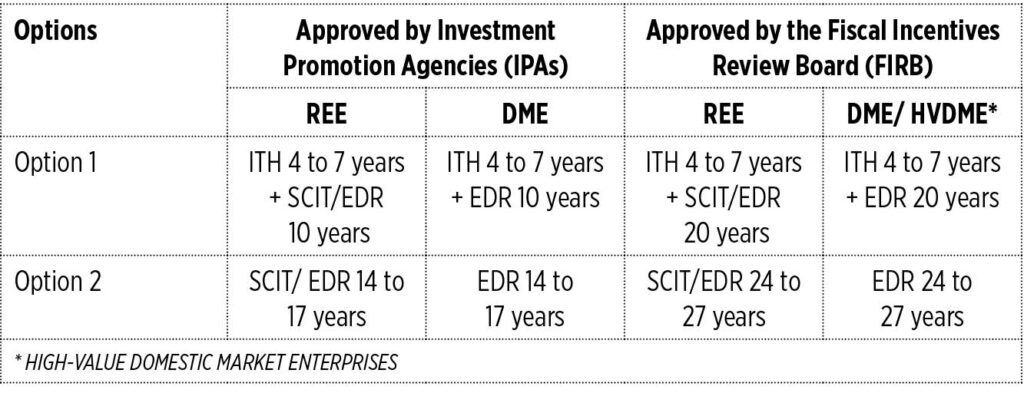

The availment period of incentives under the CREATE MORE Act is as follows:

VAT EXEMPTION AND ZERO-RATING

1. Eligibility criteria for VAT exemption and zero-rating

VAT incentives will be applicable to goods and services that are “directly attributable” to the registered project or activity of a registered company. This clarifies the rules governing VAT incentives provided in the CREATE Act, which are rather vague and subject to various interpretations that led to issues in its implementation.

The CREATE MORE Act specifies that the following goods and services, if used directly in the registered activity, will qualify for VAT exemptions or zero-rating:

• Janitorial services

• Security services

• Financial services

• Consultancy services

• Marketing and promotional services

• Administrative operations, including human resources, legal, and accounting services

2. Conditions for VAT exemption and zero-rating

Further, the CREATE MORE Act specifies the conditions under which VAT exemption and zero-rating apply.

• VAT Exempt: Goods imports by an REE whose export sales are at least 70% of total annual production of the preceding taxable year;

• 0% VAT: Sale of goods and services to/for REEs whose export sales are at least 70% of the total annual production of the preceding taxable year; or

• 0% VAT: Sales to bonded manufacturing warehouses of REEs

This clarification ensures that companies understand which services are eligible for VAT relief, preventing abuse of the incentive and ensuring that only activities directly related to the core operations of a business benefit from VAT exemptions or zero-rating.

3. VAT treatment on the sale, transfer, or disposal of previously VAT-exempt imports

The CREATE MORE Act clarifies VAT treatment of the sale, transfer, or disposal of previously VAT-exempt imported capital equipment, raw materials, spare parts, and accessories as follows:

• 0% VAT: Purchaser is an REE (regardless of location);

• 0% VAT: Seller is a domestic market enterprise (DME), and purchaser is an REE (regardless of location); or

• 12% VAT: If the seller is a DME (regardless of location), VAT shall be based on the net book value of the capital goods or materials.

4. Special provisions for high-value DMEs

Under the CREATE MORE Act, DMEs that have investment capital of at least P15 billion and are either import-substituting or catering to non-resident markets OR those with export sales of at least $100 million will enjoy enhanced 0% VAT on local purchases and VAT exemption on imports.

This provision may attract major investments in sectors that are critical for economic development, such as infrastructure, heavy industries, and export-oriented manufacturing.

RBEs AND LOCAL TAX

Companies eligible for tax incentives, including those enjoying income tax holidays (ITH) or EDR, will be subject to a local tax of up to 2% of gross income, in lieu of all other local taxes and fees. This will reduce the substantial administrative and financial burden on companies, allowing them to concentrate more on their operations rather than dealing with local taxes with varying complexities.

This would be applicable during the ITH or EDR period, provided the RBE is registered and maintains such registration throughout the duration of its ITH or EDR period with the appropriate IPA and meets the criteria set forth, such as engaging in export activities or critical domestic market services.

As businesses take advantage of these tax incentives, it is anticipated that the Philippines will experience enhanced flow of foreign investments, employment in high value-added industries, and the continued expansion of key sectors. It is hoped the CREATE MORE Act will make the Philippines more competitive in the global marketplace, making it an ideal location for businesses looking to invest, expand, and thrive in the region.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Paul Vinces C. Leorna is a manager from the Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd. pagrantthornton@ph.gt.com